Frequently Asked Questions

Explore answers to frequently asked questions to learn more about the GroundBreak Coalition, the Shared Financial System, accomplishments to date, and what’s coming next.

Revised October 30, 2023

Looking for an easy-to-share version of this FAQ?

Overview

What is GroundBreak?

GroundBreak Coalition is a group of over 40 corporate, civic, and philanthropic leaders committed to building a more inclusive, racially equitable, and climate-ready region. Formed after the murder of George Floyd, GroundBreak’s goal is to permanently close racial wealth gaps by changing how we deploy capital in the region. That is, the financing or funding needed for a person to participate in activities that build wealth, such as buying a home or starting a business.

Our strategy to expand wealth-building opportunities has a current focus on building Black wealth. GroundBreak launched its work in 2022 with a broad coalition tasked with researching how flexible capital could be leveraged to unlock market-rate capital at scale.

What does GroundBreak seek to accomplish?

By fundamentally changing how capital is deployed, our goal is to permanently close racial wealth gaps so every person, no matter their race or background, can share in the region’s prosperity. In the next decade, GroundBreak aims to contribute to the following outcomes:

- 11,000 new Black homeowners

- 60 Black-led neighborhood commercial developments

- 5,000 additional Black entrepreneurs creating 8,000 jobs and

- 23,500 affordable rental units

These measurements emerged from existing analyses of regional wealth building opportunities.

Why this approach?

Our national crises of racial, economic, and climate injustices were simmering long before the pandemic and George Floyd’s murder brought them to a boil. Nowhere is this more evident than in the Minneapolis-St. Paul metropolitan area (MSP) where the economic gulf between Black, Indigenous, and people of color (BIPOC) and white families is higher than nearly anywhere else in America[2]. MSP has come together since the uprisings in extraordinary ways to rebuild and reimagine a more equitable, climate-ready future. Together, we have the unique opportunity to transform MSP from the epicenter of America’s racial reckoning to the epicenter of racial opportunity. In doing so, we can create a roadmap for cities nationwide.

In recent years, many organizations have made bold, visible commitments to address racial inequities and preserve a safe climate by leveraging their institutional power and dedicating resources to create a shared strategy for racial, economic, and climate justice. We are galvanizing these commitments and holding ourselves accountable for meeting them.

How is GroundBreak working to achieve these goals?

In 2022, GroundBreak work groups, which included over 170 partners from across the non-profit, private, public, and philanthropic sectors, engaged in a human-centered design process to understand what financial tools and products,, if fully enacted at scale, could make a difference for Black homebuyers, commercial developers, entrepreneurs, and renters. Nine financial tools and products were identified, including many proven solutions such as down payment assistance, grants for start-up businesses, and low-cost loans. Informed by community need and ideas, work groups focused on traditional paths to wealth building, as well as rental housing given the critical importance of housing stability.

Importantly, GroundBreak encourages institutions that hold capital to change their systems and processes to better serve Black wealth builders. With this in mind, coalition leaders realized that they could mobilize capital at scale for financial tools and products identified by work groups if they built a shared financial system. In 2023, GroundBreak’s steering committee is working to build and invest in a shared financial system that can unlock these solutions at scale. .

How much capital does GroundBreak seek to mobilize?

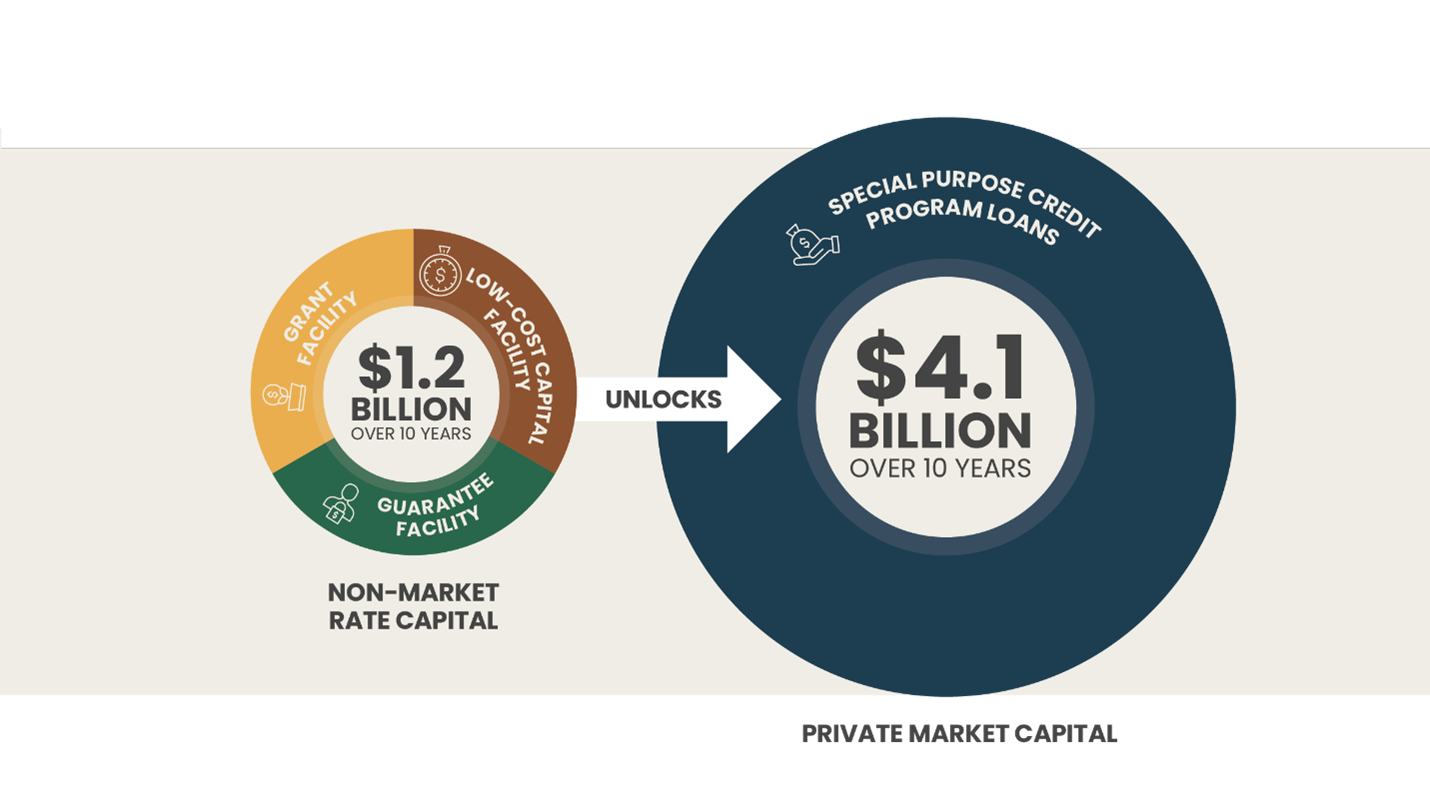

To achieve GroundBreak’s goals for the region, we seek to mobilize $5.3 billion in capital. Through a shared financial system, about 77% of this would be private, market-rate capital. The remaining $1.2 billion would be flexible, non-market rate capital.

Where does GroundBreak work?

Right now, GroundBreak’s efforts are focused on Minneapolis-St. Paul Metro area, though we believe the results of the work can be and will be relevant in ways that could be applied to communities across the state and the entire country.

How is this different from past community and economic development efforts?

GroundBreak aims to amplify the impact of past efforts by drawing more capital to the region, and by bringing more people to the table. There are three main ways GroundBreak’s approach is different than past efforts.

First, GroundBreak is a large-scale, regional response to racial wealth disparities. It aims to close the racial wealth gap by delivering long-term, dependable capital (funding) that can repeatedly fund the hopes and aspirations of people in the region who traditionally have not been able to access this capital. In short, it’s not about temporary fixes or funding, but instead, it’s seeking to transform the system to work in ways it never has before so it can intentionally close racial wealth gaps over a 10-year period.

Second, GroundBreak brings private capital to the table in a coordinated, transformational way. A critical mass of financial institutions has agreed to provide plentiful, private capital through specific products with terms and underwriting that address historic barriers to make them accessible to Black households, as defined by the community.

Finally, GroundBreak’s approach means the onus to transform systems is placed on the institutions that control capital. This includes financial institutions providing the required market rate loans, philanthropy, governments, corporations, and investors pledging assets for grants, guarantees, and low-cost capital.

Building and Investing in a Shared Financial System

What is GroundBreak’s shared financial system?

The shared financial system is a way to organize capital in MSP toward building Black wealth in a way that is systematic and achieves scale. It considers the reality that our financial systems were not designed for underinvested communities and that given our state’s history and existing racial wealth disparities, we need transformative change to level the playing field.

The system works by blending flexible, non-market rate capital (from places like philanthropy, government, corporations, and other investors) with market-rate capital provided by financial institutions. The four interdependent parts of the system work together so transactions can be easily repeated, and results can compound over time.

What is the difference between GroundBreak and a fund?

While funds are typically time-limited pools of money that are raised for certain purposes and eventually run out, GroundBreak is working to create permanent mechanisms through shared strategies adopted by private, public, and philanthropic partners. We are currently working to build the enduring systems that make more financing and funding easily and readily available to Black wealth builders. GroundBreak is not creating a fund, but fundamental change.

When will the financial system launch?

Financial tools and products are expected to be available by the end of 2024.

What is GroundBreak’s non-market rate capital investment goal?

To achieve impact goals, GroundBreak seeks to mobilize $1.2 billion in flexible, non-market rate capital over the next decade. To stay on track, we are working to secure $250 million in non-market rate capital investments by December 31, 2024.

Who will provide this capital?

Initially, each institutional member of GroundBreak is expected to contribute toward the financial system over the next three years. Longer term, we expect to raise capital from local, state, national and even global investors.

Who will decide where funding will go?

Approved partners working in each of GroundBreak’s focus areas (homeownership, commercial development, entrepreneurship, rental housing) will be to draw down capital to finance GroundBreak financial tools and products. These approved partners will include financial institutions, nonprofits, and community development financial institutions and will be identified by implementation teams in 2024.

Who will manage each part of the financial system?

GroundBreak steering committee members are in the process of establishing the coalition’s long-term governance structures in addition to standing up each component of the financial system and determining their management. This work will likely continue into early 2024.

Will there be any project-based or general funds available for nonprofits working in aligned areas?

With more capital available, nonprofit partners will need more capacity to provide grants and loans for homebuyers, entrepreneurs, and commercial developers. GroundBreak is encouraging its members to complement their investments with grantmaking for capacity

Is GroundBreak competing with local organizations for funding?

GroundBreak seeks to augment existing regional efforts—it should not stall or compete with initiatives working toward common goals, we encourage complementary grantmaking to bolster the capacity of local partners. Once the system is established, it will operate behind the scenes to serve the region and enable greater scale and impact, shifting the burden of aggregating resources from nonprofits to capital providers. Additionally, institutions are exploring creative ways to leverage their assets outside of traditional grantmaking to power GroundBreak.

What is GroundBreak’s governance structure?

In its initial phase, GroundBreak partners established a steering committee comprised of local philanthropic, corporate, financial, and government sector leaders supported by work groups that included nonprofit and community leaders. The steering committee is currently updating its governance structure to support the coalition’s next phase. Additional updates will be shared at GroundBreak’s next public event in October 2023.

Recent Accomplishments and Next Steps

What are GroundBreak’s recent accomplishments?

Since its launch in May 2022, the GroundBreak Coalition has made significant progress with growing momentum.

- In 2022, over 170 individuals and 120 organizations came together to identify and develop 9 capital financial tools and products that could close racial wealth gaps in homeownership, entrepreneurship, and commercial development.

- In 2023, GroundBreak’s steering committee began the work of building a shared financial system—the first of its kind in the nation—that can deploy capital financial tools and products at scale in a systematic, efficient way. By doing so, GroundBreak’s tools will become financial ‘commodities’ in the region, so transactions can be made repeatedly, thousands of times. In the summer of 2023, leaders began to identify what it will take to establish guarantee and low-cost patient capital facilities.

- In 2023, the state Legislature made historic investments in housing, including down payment assistance for first-generation homebuyers. This influx of flexible capital allowed GroundBreak’s steering committee to jump-start the development of special purpose credit program loans and tools for homeownership.

- GroundBreak is preparing to announce its first financial commitments toward the effort in October 2023.

What is the status of rental housing work?

Where we live impacts everything and stable housing is critical to realizing many of the aspirations we share. Earlier this year, capital protypes were released for homeownership, entrepreneurship, and commercial development, and additional work is still needed on rental housing. GroundBreak approached its work on rental housing with the understanding that Black families deserve the opportunity to build wealth as renters, and that housing stability is often critical to other wealth building endeavors like buying a home or starting a business. GroundBreak is continuing to explore how private market capital can support affordable housing development and what opportunities might be available for the region with the State’s historic investment in housing in 2023, including a new metro sales tax that will provide ongoing funding for affordable housing.

What are GroundBreak’s next steps?

- Continue building the financial system for grants, low-cost capital, and guarantees.

- Develop special purpose credit program loans adopted by a set of financial institutions.

- Continued work to update the governance structure to support programmatic work.

- Announce first round of public commitments and governance updates on October 31, 2023.

- Secure non-market rate capital investments ($250 million by December 31, 2024).

- Complete significant progress toward the shared financial system and begin deploying capital in late 2024.

How can I support GroundBreak as an institution or investor?

Please contact Ben Hecht, senior advisor at McKnight Foundation to learn more: bhecht@mcknight.org.

Who can I contact or where can I learn more?

We always welcome questions and feedback. Please contact us at info@groundbreakcoalition.org and find updates on our website: https://groundbreakcoalition.org.

Notes:

[1] “Non-market rate” capital refers to funding or financing from sources like governments, philanthropy, or other investors who can provide capital at a lower cost than the private market. In addition to lower costs, non-market rate capital can also be provided with more flexible terms and conditions.

[2] Racial inequality is among the worst in the nation, Washington Post, May 20, 2020.