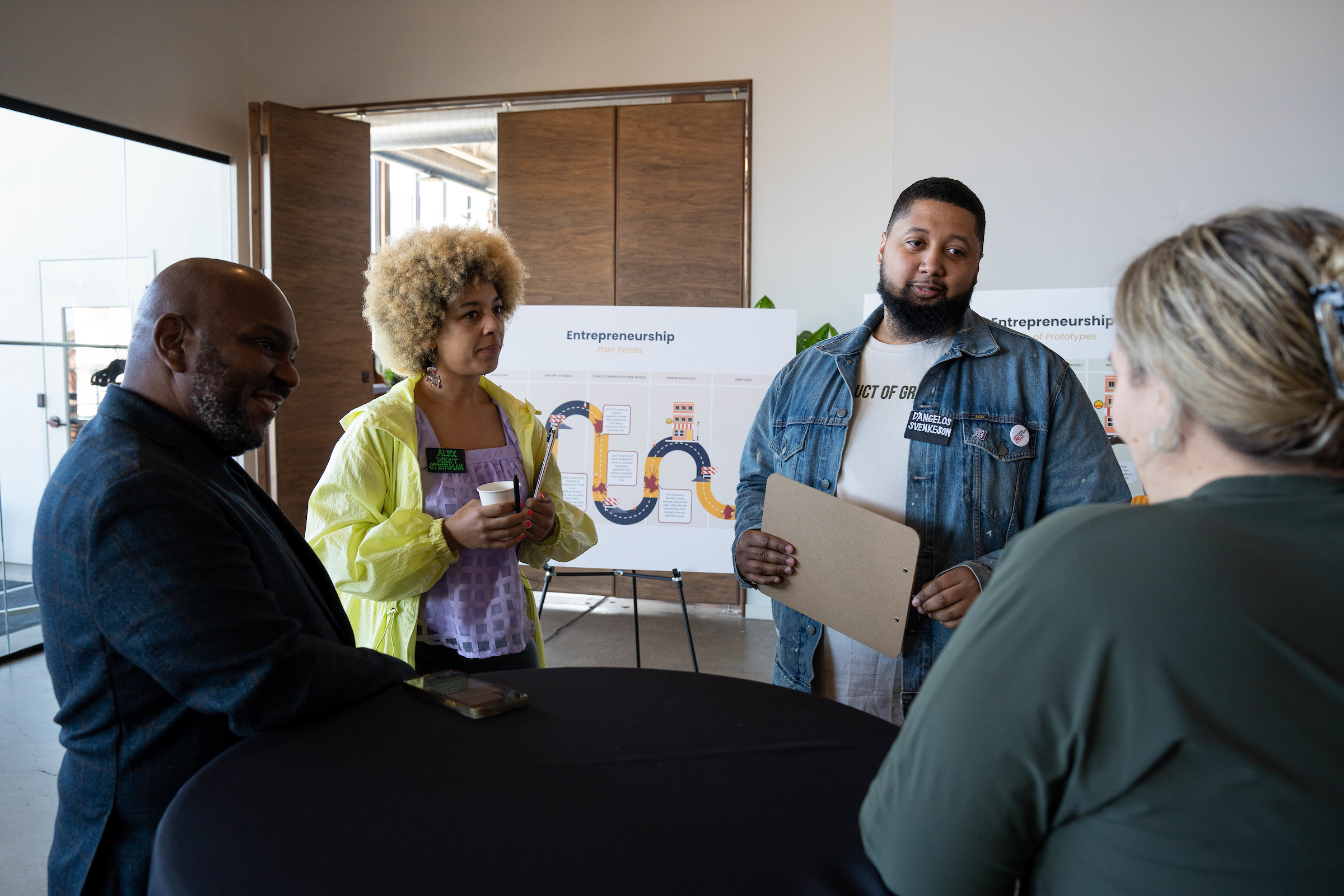

Photo Credit: Molly Miles

As a region, we have incredible prosperity, ability, and strength. We’re home to 15 Fortune 500 headquarters, and we have the 15th largest metropolitan economy in the U.S. We have enormous wealth in our region, though not everyone experiences that prosperity. For too many, it’s a tale of two Twin Cities, because Minneapolis-St. Paul also has one of the widest racial wealth gaps in the nation.

Generational wealth disparities limit opportunities for Black, Indigenous, and people of color striving to invest in their futures and fully realize their visions in our region. The barriers to building wealth are higher for entrepreneurs of color who have the ideas and ambition, but not the network of investors or financial cushion that can make it possible to take the leap into starting a business. Wealth disparities make it harder for people who want to buy a home to come up with funds for down payments and other costs. A potential homebuyer gets stuck in a cycle of paying rent each month for a home that someone else owns. A better deal is possible.

The GroundBreak Coalition seeks to interrupt this vicious cycle that perpetuates our “tale of two cites” by investing in our region’s greatest assets: the aspirations of people who live here, using a targeted universalist approach focused on Black wealth builders.

Over the next decade, GroundBreak will do that by unlocking $5 billion of capital to build Black wealth and close racial wealth disparities in Minneapolis-St. Paul. Achieving this will require our region to build new systems that enable capital to flow at scale to Black wealth builders.

This summer, GroundBreak is beginning the work of building a shared, regional financial platform. By doing this, our region will be able to provide a reliable, long-term, and consistent source of financing for wealth builders in the region.

We are excited to move this innovative platform forward to create a central hub for directing and scaling investments that can fund aspirations and shrink wealth gaps, for good.

Below is everything you need to know about this innovative approach.

Q: What is the purpose of building a shared, regional financial platform?

Put simply, as a region and across sectors, we can do more together. If there is a shared system that can deliver repeated, reliable results that can fund the aspirations of people in our region, we will be able to build on the successful solutions and products currently available to ensure we’re meaningfully addressing persistent barriers to entry for people seeking to buy a home, start a business, or bring locally-owned, commercial developments into our communities.

How do we get there? Through Groundbreak, we are seeking to build a shared, financial platform that will allow our region to aggregate, mobilize and blend capital (both “market-rate” capital with interest rates determined by the open market and “non-market capital” from sources like philanthropy and government that can have lower interest rates, or none at all) repeatedly and efficiently into specifically defined financial solutions and products for Black wealth builders working to start or grow a business, develop commercial property, or buy a home.

In other words, it makes access to capital predictable, reliable, and streamlined – expanding opportunity and easing burdens on wealth builders. The platform enables results at scale because it uses a small amount of non-market rate capital such as loan guarantees, low-cost loans and grants to systematically unlock large amounts of market-rate capital.

Overview of the Shared Financial System.

Q: What will the financial platform make possible for wealth builders?

Once the platform is built, an entrepreneur may access a forgivable loan to launch their business with investments from the grants facility. A commercial developer may be able to access senior debt for a new development because their lender provides a special purpose credit program loan on GroundBreak terms and has an agreement with the guarantee facility that their GroundBreak Coalition loans will be guaranteed. A homebuyer may be able to access $50,000 in down payment assistance through financing that is available through the platform. The breakthrough comes by mobilizing all types of capital needed to fund the prototypes at scale, in one region so $1 of non-market rate capital unlocks $3 in market rate capital. This means more financing will be available in our region, in a way that is scalable, predictable, and efficient.

In short, we can have a much larger impact through a shared platform like this than without it. By contributing resources across sectors and bringing a range of solutions to the table in one region, we can make our money go further, creating more homeowners, investing in more entrepreneurs, bringing more locally-owned commercial developments to life. Ultimately, having a coordinated, scaled, and consistent approach to increasing equity and prosperity across our region.

Q: What does the shared financial platform entail?

GroundBreak’s financial platform will include four interdependent parts:

- A shared, regional special purpose credit program collectively adopted by a set of financial institutions to ensure Black homebuyers, entrepreneurs, and commercial developers have access to capital with standard loan terms across participating lenders to limit confusion, build trust, and provide choice.

- A guarantee facility to unlock capital for commercial developers and early and growth-stage businesses.

- A low-cost, patient capital facility to provide funding for low-cost loans with long-term payback conditions for homebuyers and commercial developers.

- A one-time, strategic investment or grant facility to provide funding for grants and forgivable loans for homebuyers through tools like downpayment assistance, commercial developers, and entrepreneurs starting a new business.

Q: How would each facility work?

The facilities would not make funding decisions. They simply would aggregate the resources, serve as a conduit to approved partners or ‘delegated underwriters’, and report annually on deployment, performance and impact.

Approved partners would be those institutions who have agreed formally to participate in the system and to follow the specific underwriting terms of the GroundBreak Coalition (GBC) prototypes, without exception. If all approved partners involved certify compliance with GBC terms, the necessary resources could be drawn down from the platform to complete the transaction.

For example, with certification that a home mortgage was approved in compliance with GBC terms, an approved nonprofit downpayment assistance partner could draw down half of the required funds from the grant and low-cost capital facilities, respectively.

Q: Who is responsible for building it?

Financial institutions must provide the special purpose credit program loans under the terms proposed by GroundBreak working groups. Philanthropy, governments, corporations, family foundations, and private investors must be leaders in the guarantee, low-cost capital, and one-time, strategic investment facilities.

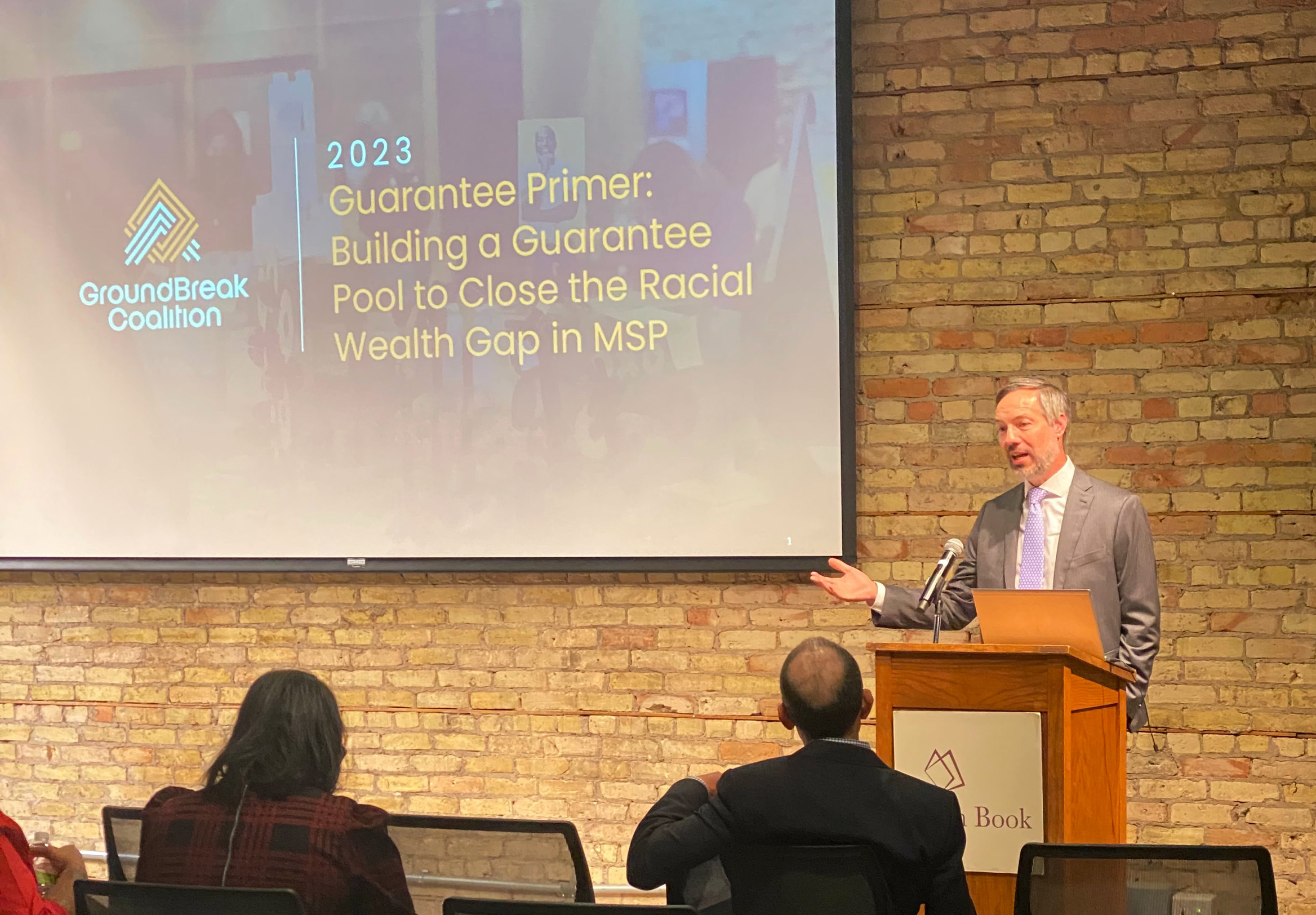

Minnesota Department of Employment and Economic Development Commissioner Matt Varilek provides inspiring opening remarks at this month’s event exploring the role of a local guarantee pool to support BIPOC developers and entrepreneurs. We were also joined by Jim Baek, Executive Director, Community Investment Guarantee Pool, the nation’s leading guarantee facility. This primer is an important part of an effort to secure guarantee commitments from local investors of at least $25 million by October 2023.

Q: What is the status of the platform development?

To create a region where every person, no matter their race or background, has the opportunity to thrive, GroundBreak aims to make transformative and permanent changes by building new systems that can make an outsized impact. Thoughtfully accomplishing this innovation will take time, and we are excited to see the progress and enthusiasm to date—once the platform is developed, it will be the first of its kind in the nation.

This summer, GroundBreak leaders on the steering committee are in the early stages of researching and developing the financial platform. Financial institutions have started to establish a special purpose credit program for homeownership and dozens of leaders across the coalition have started to research how our region can develop guarantee and low-cost capital facilities. Platform development will continue throughout the year, and we will keep you updated as work progresses.

The Bottom-Line: By building a shared, financial platform, we will be able to unlock billions of dollars in capital for Black wealth builders by directly addressing the most common barriers people without generational wealth face when starting or growing a business, buying a home, or developing commercial property.

The framework puts the onus on institutions to change so they work for Black wealth builders. Once established, the platform will provide efficient, predictable, and permanent financing sources to ensure market-rate capital is unlocked for Black wealth builders and stays that way.

Learn more on this podcast episode Creating a racially equitable economy – Minnesota’s GroundBreak Coalition produced by the Harvard Kennedy School.